SavaNet at the nexus of fundamental and quantitative analysis.

About us

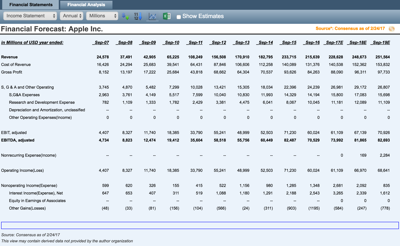

SavaNet is the industry leading modeling data and analytics platform. The SavaNet RMAS™ system combines a research database, model data management and distribution system with the most advanced equity analytics platform available. It combines client, consensus and market data and automatically creates and updates calculated metrics. Data can also be accessed via data feeds for models data, factor analytics, valuation series, and macro factor sensitivities. SavaNet is the only source for consensus three-statement valuation models, built on the back of our proprietary "IFRICS" taxonomy -- a five level, 3700 item universal taxonomy set that can standardize data from any source.